Lesson 8: Reserves, Profit & APV

Calculate APV

If you calculate reserves using gross premium valuation (“GPV”) method in your spreadsheet models, you can use one of the two methods below:

- Calculate reserves directly using required cash flows, i.e. adding (+) the outgo and deducting (-) the income.

- Calculate individual actuarial present values (“APV”) for individual cash flow items, and derive reserves from the individual APVs.

Reservest = APV(Future Outgo)t - APV(Future Income)t

Please note that the 2nd method cannot be used to calculate reserving under sterling reserve method (common reserving method for investment-linked products). For statutory reporting in Malaysia, it is common to report individual APV components in the annual valuation reports.

Calculate APV for Individual Cash Flow Items

Calculating APV components for the individual cash flow items helps us in understanding particular result, such as reserves and embedded values. By examining the APV components, we are able to identify components that are the main contributor to the results.

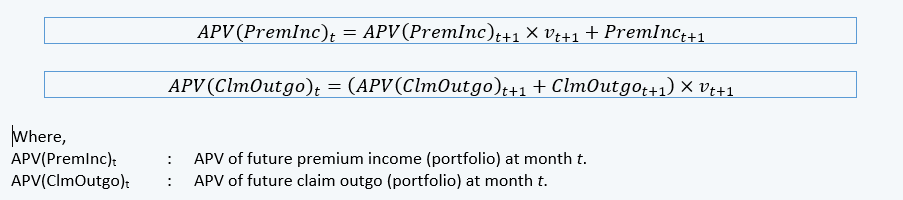

Normally APV components are calculated on portfolio basis. We may calculate APV components by using recursive method, i.e. by reusing results from the next period:

- Identify timing of occurrence for a cash flow item carefully, i.e. at the beginning or end of the month. The value of APV components should always be calculated as at end of the month.

- We assume claims occur at the end of month, hence the claim outgo needs to be multiplied with the discount factor, v.

- We assume premiums are received at the beginning of month, hence the premium incomes do not needs to be multiplied with the discount factor, v.

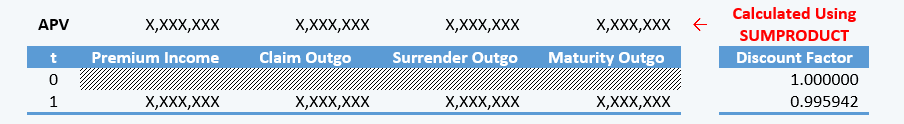

In case you require only APVs as at valuation date, instead of calculating APV components as at every t, you can directly use SUMPRODUCT on spreadsheet (cash flows IF × Discount Factor).

- The discount factor for t = 0 is set to 1. Discount factors for t > 1 are calculated using recursive methods – please take note that the discount rates may vary by financial year / calendar year.

- For cash flows occur at the beginning of month, the discount factors used should start from 1.000000.

- For cash flows occur at the beginning of month, the discount factors used should start from 0.995942.