Lesson 2: Insurance Revenue Account

How to Construct a Revenue Accounts?

As shown in Chapter 1, a cash flow model is constructed by policy year, instead of calendar year. However, revenue accounts are presented by calendar month / year and in force policies are set in force at different points of time.

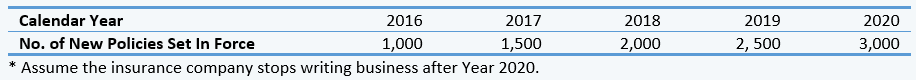

Assume the above-mentioned cash flow model is for 50 policies. We need to construct a 10-year annual revenue account (2018-2027) for the following portfolio (all policies with same characteristics):

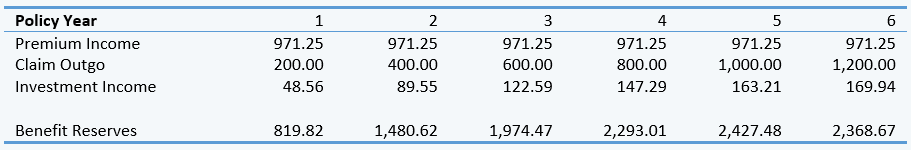

STEP 1: Get Per Policy Cash Flow Profile

To get the per policy cash flow profile, divide the premium income, claim outgo, investment income and benefit reserves by no. of policies. Next, transpose the cash flows so that it is consistent to the format required by revenue accounts. (Please note that the following illustrations only show up to 6 years)

STEP 2: Derive Cash Flows for Each Block of Policies, by Fitting into Calendar Year

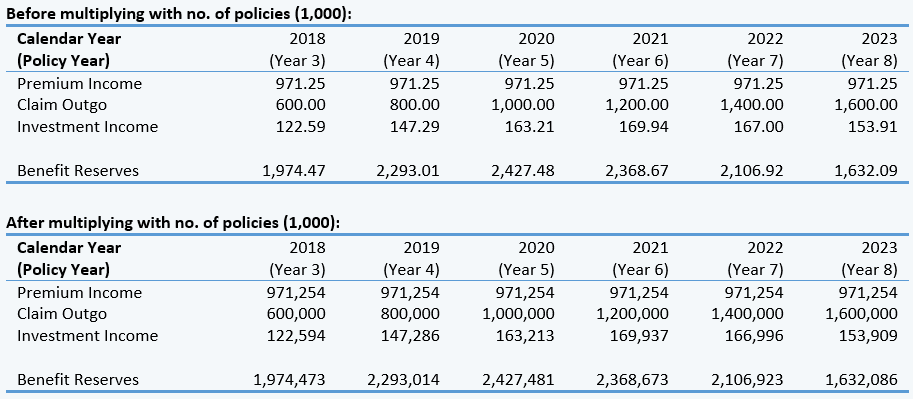

For a particular issue block, organize the cash flows by calendar year (by referring to the issue year) and select only cash flows occur from 2018 to 2017. Multiply with respective no. of policies.

For issue block which are issued in 2016, the projected cash flows for Year 2018-2023 are as follows:

Repeat the above for each issue block. For calendar years before a particular issue year, all cash flows are set to zero.

STEP 3: Combine Projected Cash Flows for All Issue Blocks

Combine projected cash flows from all issue blocks.

For example, premium income received in Year 2018 comes from issue blocks 2016, 2017 & 2018:

Premium Income2018 = 971,254 (Y2016) + 1,456,881 (Y2017) + 1,942,509 (Y2018) + 0 (Y2019) + 0 (Y2020)

= 4,370,644

STEP 4: Populate Projected Cash Flows to Revenue Account Format

Populate projected cash flows according to the revenue account format stated on Page 10. For items that are unavailable from the projected cash flows, set to 0 (including investment tax & corporate tax).

Calculate gross profit (before tax) and net profit (after tax). Could you explain the values you get?