Lesson 1: Introduction to Cash Flow Modeling

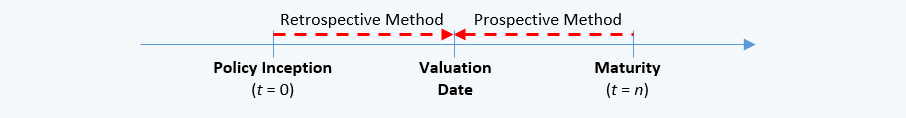

Retrospective vs. Prospective

A cash flow model can be constructed using either retrospective method or prospective method. To calculate a particular value (e.g. benefit reserves) as at valuation date:

- The retrospective method is backward looking. It accumulates cash flows occur from policy inception to valuation date. Example: Asset share.

- The prospective method is forward looking. Discounts cash flows occur after valuation date until maturity. Example: Gross premium valuation (“GPV”).

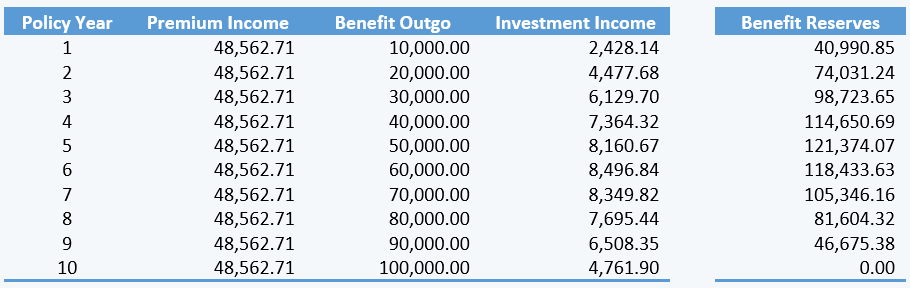

Let’s look at benefit reserves calculation for a portfolio with premium income, benefit outgo and investment income shown in the table below. Although prospective method is the most common method in determining reserves (using net level premium method), we can actually use both retrospective & prospective methods for the calculations.

- First, calculate net premium by assuming no investment income.

- Next, update net premium calculation by allowing investment income, calculated using investment yield = 5.00% p.a. Use goal seek method if needed.

Assumptions & Simplifications:

- No policy termination occur during the entire cash flow period.

- Total sum assured is 1,000,000. Claim rate for year 1 is 0.01 and it increases by 0.01 annually.

- Valuation assumptions and actual experience are exactly the same. Annual premium is derived using net level premium method.

For the scenario with investment yield = 5.00% p.a., you should get the results as shown below:

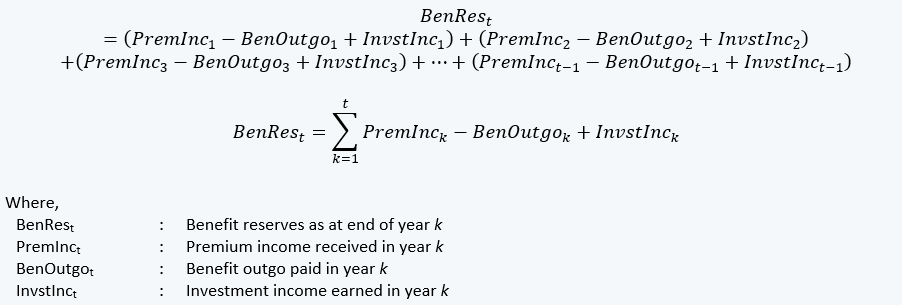

To calculate benefit reserves retrospectively:

To calculate benefit reserve as attend of Year 3, we need to consider all cash flows occur from Year 1 to 3, i.e.

BenRes3

= (48,562.71 – 10,000.00 + 2,428.14) + (48,562.71 – 20,000.00 + 4,477.68) + (48,562.71 – 30,000.00 + 6,129.70)

= 98,723.65

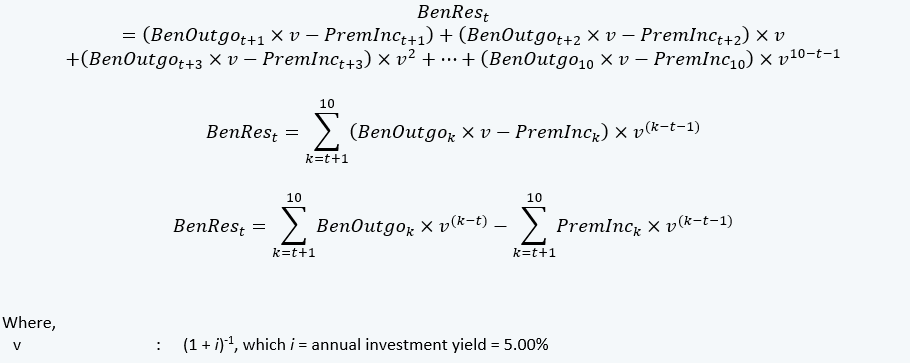

To calculate benefit reserves prospectively:

To calculate benefit reserve as attend of Year 3, we need to consider all cash flows occur from Year 4 to 10, i.e.

BenRes3

= (40,000.00v + 50,000.00v2 + 60,000.00v3 + 70,000.00v4 + 80,000.00v5 + 90,000.00v6 + 100,000.00v7) – (48,562.71 + 48,562.71v + 48,562.71v2 + 48,562.71v3 + 48,562.71v4 + 48,562.71v5 + 48,562.71v6)

= 98,723.65

By using net level premium method above, both retrospective method and prospective method produce same results.

Recursive Formula

In the previous section, under retrospective method, benefit reserves as at every point of time are calculated by summing up ALL accumulated cash flows occur before the calculation dates. In term of the perspective of actuarial modeling, such approach is considered as inefficient as it utilizes plenty of computer resources and increase run time tremendously (such as actuarial models setup in Prophet).

So, what is a more efficient approach to setup an actuarial model? If the model can “reuse” results calculated from another point of time (either t – 1 (before) or time t + 1 (after)), we can definitely simplify the calculations needed and reduce calculation efforts for each point of time. For example, “DiscFac5 = DiscFac4 / (1 + i)” is definitely more efficient than “DiscFac5 = (1 + i)5”, as applying power of 5 requires more computer resources.

Let’s convert the benefit reserve formulas in the previous section into more simplified recursive formulas, which have different starting values (BenRest-1 & BenRest+1):

Retrospective Calculation:

BenRest = BenRest-1 + (PremInct – BenOutgot + InvstInct)

Prospective Calculation:

BenRest = (BenRest+1 + BenOutgot+1) × v – PremInct+1